Running a small business is tough at the best of times. During Covid-19, it got a whole lot tougher, with money at the top of the list of concerns for most small business owners. So how do you start, and manage, a small business in turbulent times?

Tshetlhe Litheko, Deputy Hub Manager at Anglo American’s Zimele Hub in Emalahleni, says there has been a sharp rise in the number of people looking to get economically active and generate an income through a small business, in recent months.

No ad to show here.

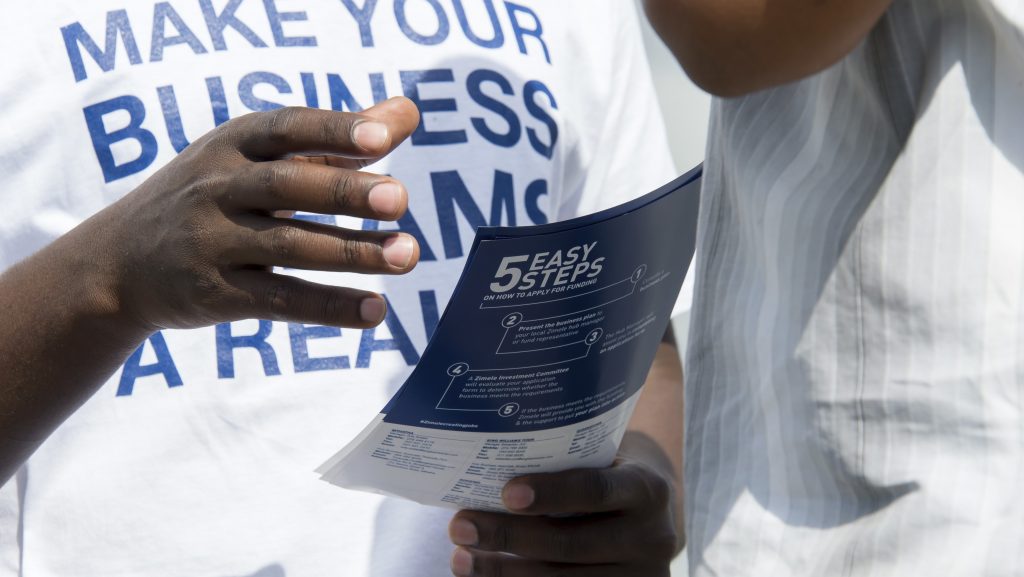

“As Anglo American’s enterprise development arm, Zimele is all about mentoring SMMEs and entrepreneurs with a focus on youth, supplier, and enterprise development,” said Litheko. “High levels of unemployment in our country mean that providing funding is simply not enough anymore. It’s vital that we as a country find ways to create jobs and grow small businesses.”

In line with Money Smart Week, Litheko shared his top tips for wannabe and existing entrepreneurs.

First, have an idea

Don’t have a business, but keen to start one? Your idea is the starting point for any small business. What is your enterprising idea? How do you think it will work and become sustainable? Only once you know that can incubators help you,” he says.

The good news? Zimele has helped many businesses go from bright ideas to fully-fledged supplier.

Get on top of your cash flow

If you’re an existing business, the first thing that Zimele helps you with is to understand your cash flow patterns, how to manage them, and how to improve cash flow. You should be able to identify when your business tends to do well, and when revenue is slow, so you can plan accordingly. This is will also help you build a cushion for when growth is slow.

Stabilise your balance sheet

Once cash flow is under control, you have to ensure your balance sheet is stable. “Don’t be afraid of loans and funding. It’s vital that you invest in the business to get the productive tools you need, whether that’s a bakkie or a piece of equipment. But you can only do this when you are able to show a lender a robust balance sheet,” says Litheko.

Separate your business from your personal finances

The biggest mistake small business owners make is to either use the business to fund their lifestyles or not to pay themselves at all. It’s important that your business stands alone, even if you’re a one-person show, for tax and business credit purposes, among others. Then be sure to pay yourself: you’re part of the business too.

Spend some time getting mentorship

Most small business owners have a specific set of skills and an entrepreneurial mindset. But often, they lack the skills in business, financial management, and marketing that will help them take their businesses to the next level. That’s why it’s vital that entrepreneurs find themselves a mentor, either through a business incubator or an experienced business owner, says Litheko.

“The ultimate goal for many small business owners is to get to the point where they can step away from the business, and it will run sustainably without them. But it takes a lot of work and focus to get to that level of maturity,” said Litheko.

This article was written by Tshetlhe Litheko, Deputy Hub Manager at Anglo American’s Zimele Hub.

Featured image: Supplied