LG’s 100-Inch QNED evo AI TV Redefines Big-Screen Viewing in South Africa In a bold leap forward for home entertainment, LG Electronics South Africa…

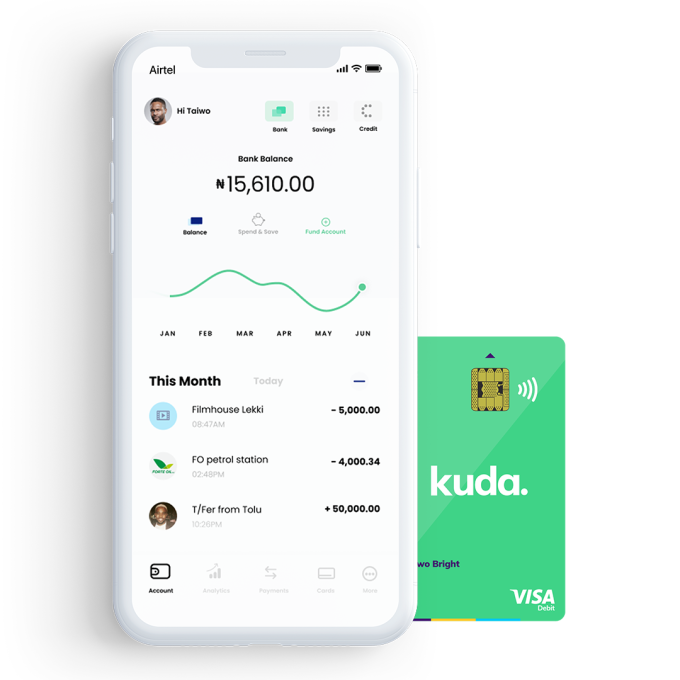

Nigerian tech startup Kuda secures $25-million

Kuda, a digital bank that operates in Nigeria has secured $25-million in a Series A funding round led by Valar Ventures, a New York-based venture capital firm.

Kuda has secured $25-million in funding

This Series A round of funding included participation from existing investor Target Global and an undisclosed international venture capital firm located in Berlin alongside several other existing investors.

The secured funding will be used to expand the fintech’s presence and services across Africa. In addition, it will be used to speed up customer acquisition, expand leadership roles, and build out new features including a new easy-to-use lending option that the company is currently trialling with select customers.

Babs Ogundeyi, CEO and co-founder of Kuda comments on the funding received and what this means for the innovative fintech startup.

“At Kuda, we know that the companies which are best able to leverage technology and talent will be the same companies which are best positioned to provide huge numbers of people across Africa with access to a vastly improved financial system that places the customer at its centre. We recognise the great strides that we have taken to get to the point at which we are now, but even more importantly we recognise just how far we still have to go to achieve our objective of providing every African with access to powerful, appropriate and affordable financial services. With this in mind, we could not be more pleased that Valar Ventures has decided to come on board and join us on this mission. Their insights and experience in helping advise some of the world’s most successful challenger banks will without doubt be a critical part of our successes going forward.”

Kuda has gained investment traction since 2020 as this investment follows on $10-million the fintech startup raised in October 2020.

According to reports issued by the fintech, the investment into Kuda is the first for Valar Ventures.

Andrew McCormack, General Partner at Valar Ventures explains that the investment aims to support Nigeria’s transition into the digital banking space.

“Nigeria is at a tipping point in the adoption of digital banking. With the rapidly growing, youthful population who are open to new financial alternatives, Kuda is well-positioned to benefit and will transform the landscape of African banking. We are excited to lead their Series A and continue on the journey alongside Kuda.” Mr. McCormack will join the Board of Kuda Technologies following the conclusion of the funding round.

Kuda

Founded in 2019 by Babs Ogundeyi and Musty Mustapha, Kuda is a full-service digital-only bank with a banking license.

The fintech-focused startup has grown to provide B2C and B2B2 banking services to consumers in Nigeria and has reportedly over $2-billion in transactions during February 2021.

Read more: New accelerator for African law startups launches

Read more: PayFast reports 412% increase in QR code payments

Featured image, left to right: Kuda founders Babs Ogundeyi and Musty Mustapha (Supplied)