Artificial Intelligence is no longer a distant promise or a Silicon Valley experiment. It’s embedded in the now. South Africans are already using generative…

The cryptocurrencies that have outperformed bitcoin

Over the longer-term Bitcoin’s astonishing price performance has been eclipsed by other smaller alternative cryptocurrencies

Twelve months ago, bitcoin was trading at $5 355. In the last few weeks, it broke $60 000 hitting another all-time high of over $61 500. That’s a 1 048% return over the last year

If that’s not spectacular enough, consider that bitcoin has gained over 100% since the start of January 2021. Since then PayPal has started offering cryptocurrency-related services, Goldman Sachs created a crypto dedicated trading desk and Tesla bought $1.5Bn worth of Bitcoin and just a few days ago announced that you can now buy their cars using Bitcoin.

Big-name corporates and investment banks have also changed their tone with crypto and have come out with price predictions suggesting the current bull run still has plenty of headroom.

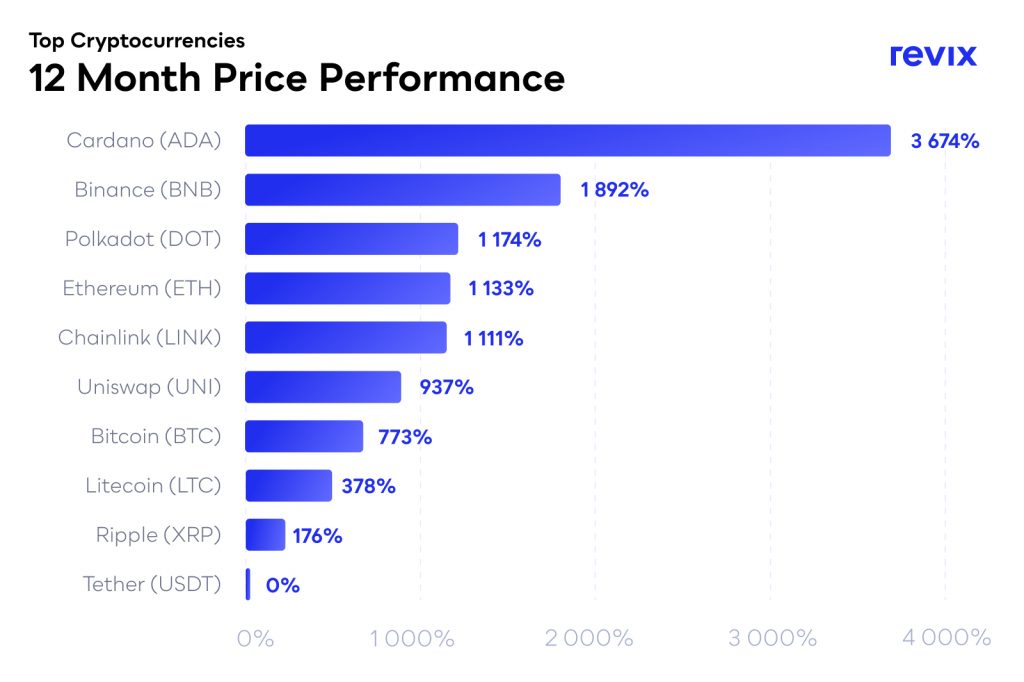

As the graph below shows, Bitcoin was by no means the top-performing cryptocurrency over the last year. It was outperformed by Cardano (3 674%), Binance Coin (1 892%), Polkadot (1 174%), Ethereum (1 133%), and Chainlink (1 111%).

Bear in mind that these are highly volatile assets and can move well over 30% up and down each month.

Virtually all of these smaller cryptocurrencies, known as alternative coins or “alt coins” are constituents in the Revix Top 10 Bundle, which has grown in unit value by more than 1 060% over the last 12 months, well ahead of bitcoin’s 12-month return.

Who is Revix?

Revix (www.revix.com) is backed by JSE-listed financial services group Sabvest and was launched in 2018 to make it secure and easy to invest in both individual and ready-made baskets of cryptocurrencies that they call crypto “Bundles”.

Customers can get started with as little as R500 and the fintech charges no sign-up, monthly account, or subscription fees, but rather a simple 1% transaction fee for both buys and sells.

The advantages of owning a crypto bundle with Revix

1.Diversification

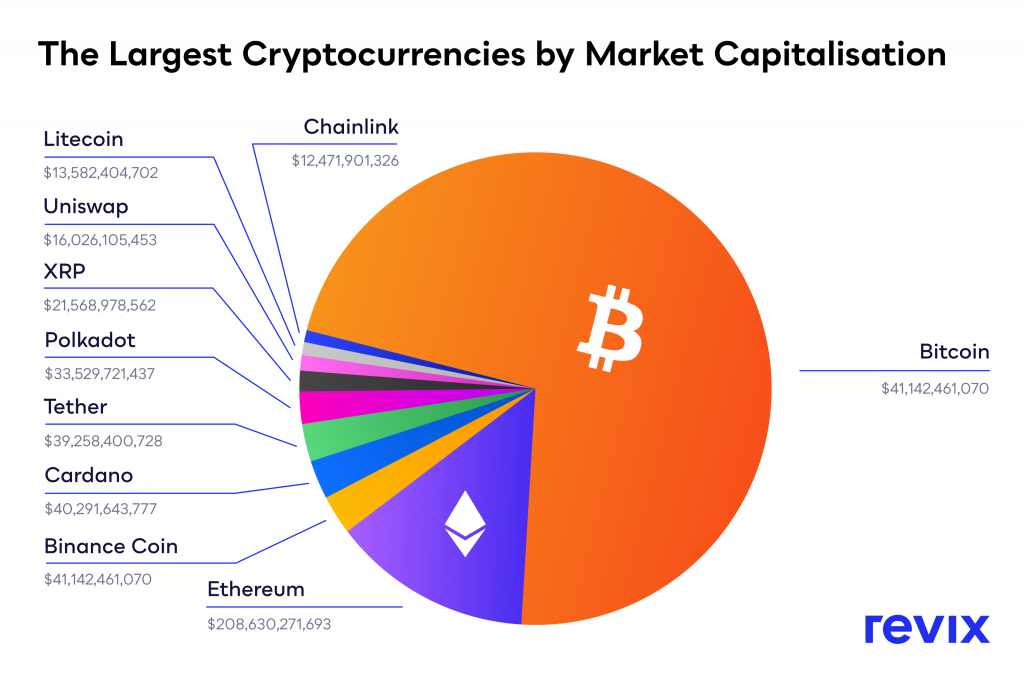

One of the advantages of investing using the Top 10 Bundle is that it equally weights each of the top 10 largest cryptocurrencies as measured by market capitalisation.

Revix’s Founder and CEO, Sean Sanders, is a Chartered Financial Analyst (CFA) who previously worked as a portfolio manager explains,

“If you were to buy a Top 10 Bundle that was market-weighted, you’d have roughly 73% of your total investment in bitcoin and Ethereum alone. That’s not a diversified crypto portfolio and it’s actually increasing your concentration risk in the largest two cryptocurrencies. If you had taken this same approach in the year 2000 with stocks you would have invested in General Motors and Walmart and would have had little to no exposure to the big success stories of Amazon and Microsoft. Additionally, if something negative happens to Bitcoin or Ethereum then your crypto portfolio is going to be seriously impacted.”

Revix’s Top 10 crypto Bundle allocates 10% to each of the 10 largest cryptocurrencies creating an equally weighted investment that is well diversified.

‘Stablecoins’ (a type of crypto-backed 1:1 by fiat currencies like the US dollar and rand) like Tether or USDC are not included as they don’t offer significant return potential as the crypto sector grows. They will always be equal to the US dollar.

2.Superior Risk-Adjusted Returns

Historically, Revix’s Top 10 Bundle has significantly outperformed an investment in both a market-weighted equivalent crypto Bundle and Bitcoin alone on a risk-adjusted basis.

Including smaller cryptocurrencies in a crypto portfolio with regular monthly rebalancing would have increased your Sharpe ratio: a measure showing how well your investment would have performed given the amount of risk you’ve taken.

“Bitcoin is viewed as the gateway into the cryptocurrency space but in five years there’s likely to be many other large-scale cryptocurrency projects gaining mainstream adoption,” says Sanders. “Owning a slice of the up and comers is the real investment opportunity. Bitcoin is now worth over $1 trillion (R15 trillion) but just seven years back was once worth only a few million dollars. Today, some cryptocurrencies are still relatively small and not well known, which could one day be worth what bitcoin is worth today.

“Historically, Bitcoin has outperformed all other asset categories, but is far behind some of the smaller cryptocurrencies that are gradually pushing their way into the upper ranks for the crypto market cap rankings.”

3.Automated Rebalancing

Revix’s algorithms automatically rebalance a customer’s Bundle holdings monthly, so that they are equally weighted to ensure that they stay up to date with the fast-changing market. This automated process means Bundle holders don’t have to manually calculate which cryptocurrencies to buy and sell on a regular basis.

4.Peace of mind

Before any cryptocurrency enters their Bundle, Revix evaluates it for security, liquidity, regulatory status, and other factors. This ensures it can be held in a safe, secure, and regulatory-compliant manner.

5.Smart price execution

Revix offers their customers a unique price-routing system enabling customers to obtain the best prices available at the moment of purchase or sale. “We aren’t a crypto exchange, and this means we have the ability to source the best pricing and liquidity for our customers across multiple crypto exchanges at any given time,” says Sanders.

Different cryptos perform different functions

“The term ‘cryptocurrency’ is a bit of a misnomer,” adds Sanders. “Cryptoassets is a better term since different cryptocurrencies do different things.”

The top performer over the last 12 months has been Cardano, which is competing with Ethereum and Polkadot to own a new financial architecture called decentralised finance, or DeFi.

Bitcoin accounts for more than 60% of the total crypto market cap, but it is seen as a robust store of value similar in function to gold.

Litecoin is regarded as the “silver” to bitcoin’s perceived status as “digital gold.” While bitcoin will never have more than 21 million digital coins in issue, Litecoin will be able to expand to 84 million. Litecoin was designed to offer faster transaction speeds than bitcoin and is positioning itself as a new form of digital money, offering speed and a relatively low price ($29) to appeal to merchants and investors.

Chainlink fulfils another purpose within the developing DeFi space, by aiming to solve one of the biggest challenges for the practical implementation of smart contracts – connecting blockchains to real-world data – such as price feeds or delivery confirmations – through so-called “oracles blockchain connectivity”. For smart contracts to work, they need external data sources that are accurate and trusted, and Chainlink aims to provide these.

So, there are a lot of crypto assets doing very different things with significant growth potential.

How to invest?

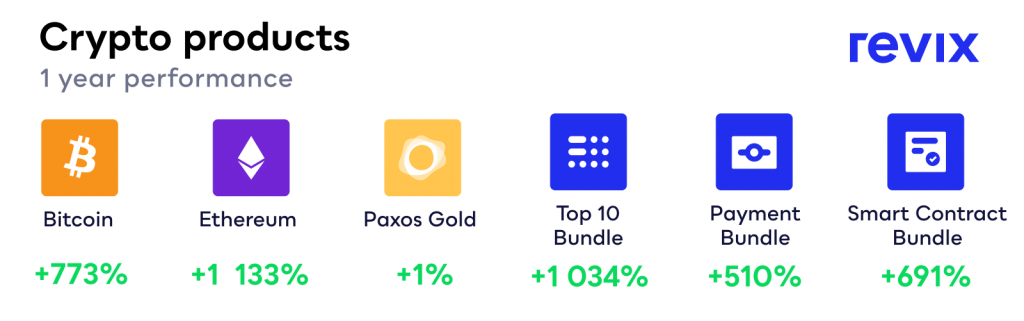

If you are working within an established, reputable crypto investing platform like Revix, you can invest in both ready-made crypto Bundles and individual cryptocurrencies including Bitcoin, Ethereum, USDC (a “stablecoin” fully-backed by the US dollar), and a physical gold-backed token called PAX Gold which provides legal ownership of an ounce of gold through Revix’s online platform.

The Smart Contract Crypto Bundle tracks those cryptocurrencies that enable smart contract functionality and include several cryptocurrencies that are looking to challenge Ethereum’s smart contract dominance.

This Bundle comprises cryptocurrencies that enable developers to build applications on top of their blockchains, much like how developers build mobile apps on top of the Apple mobile iOS operating system. The cryptos in this bundle include Ethereum, Cardano, Tron, Neo, and EOS.

Revix also offers a Payment Crypto Bundle, which provides exposure to the largest five payment-focused cryptocurrencies looking to become ‘digital cash’ and compete with government-issued fiat currencies to make digital payments cheaper, faster, and more global. These cryptos include bitcoin (BTC), Ripple (XRP), Litecoin (LTC), Bitcoin Cash (BCH), and Stellar (XLM).

Featured image: Dmitry Demidko via Unsplash

Company Office is a subscription-based press office service.