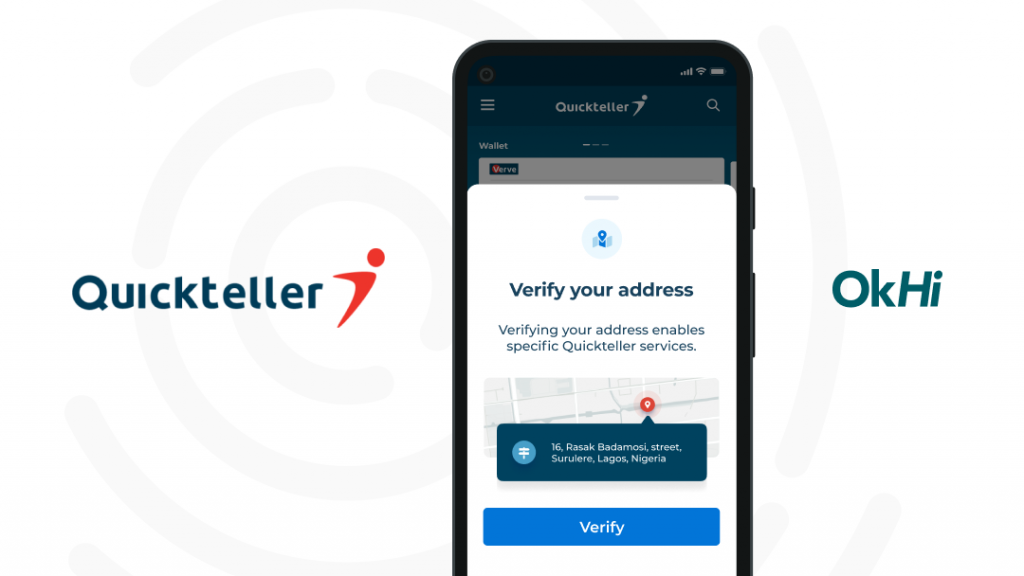

Nairobi-based OkHi, a smart addressing tech startup has partnered with Interswitch Group to launch its smart address verification product.

OkHi launches Nigeria’s first digital address verification

No ad to show here.

According to reports, Interswitch’s Quickteller, a payment and wallet service is the first business in Nigeria to use the OkHi address verification service. With the service, banks will be able to easily verify customers’ addresses via their smartphones.

The launch and partnership with Interswitch will allow its customers to access an OkHi address and this provides access to larger wallets, faster loan access and improve last-mile delivery via Quickteller’s Citimart and Global Mall.

Utilising innovative technology, the tech startup provides an alternative to traditional paper-based verification which has its own challenges. According to reports, the online service helps to reduce onboarding times and reduce operating costs.

Timbo Drayson, CEO and Founder of OkHi comments on the launch.

“At OkHi, we have developed the first solution in the world that can collect an extremely accurate address and verify it through a smartphone. To have Interswitch launching us to millions of people, via Quickteller, gives us an incredible platform to tackle financial inclusion in Nigeria.”

OkHi

Founded in 2014, OkHi is a tech startup that provides digital address verification to financial services. This innovative tech-based service helps increase access for unbanked individuals while assisting banks to gain customers and increase their user traction.

Commenting on the announcement, Chinyere Don-Okhuofu, Interswitch Group’s Divisional CEO for Industry Ecosystem offers concluding thoughts on the announcement.

“At Interswitch, we take our customers and their evolving needs seriously and we are committed to identifying opportunities to unlock economic value for Africans. This partnership with OkHi is built on the need to digitize and simplify the existing address verification system thereby dealing with another significant barrier to financial services growth across Africa.”

Read more: Free cybersecurity awareness online training for businesses launches

Featured image: Supplied