Artificial Intelligence is no longer a distant promise or a Silicon Valley experiment. It’s embedded in the now. South Africans are already using generative…

Battery energy storage systems to boost reliability and the adoption of renewable energy [Sponsored]

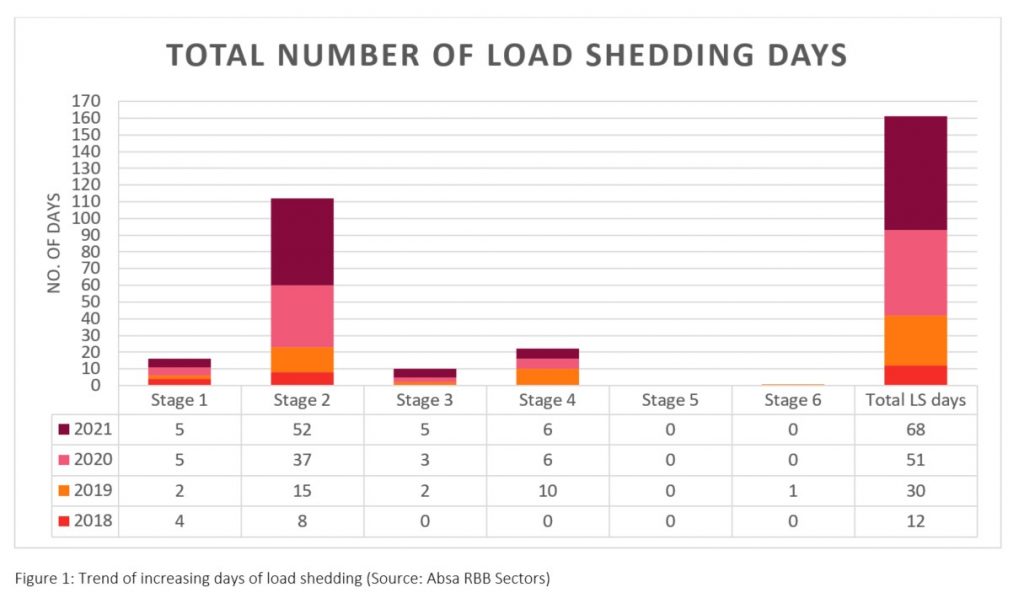

Despite historic declines in economic activity in 2020, we still saw a high intensity of load shedding. The trend of increasing hours of load shedding has continued into most of 2021.

At Eskom, the problem of unreliable generation capacity gets exacerbated by operational problems, resulting in unplanned outages at multiple generation plants – primarily because of a lack of maintenance.

Eskom’s ageing fleet of power stations and unplanned outages have hurt the power producer’s generation capacity for years and these constraints remain a key challenge for future growth.

Increasing load shedding days since 2018 highlights the challenges that Eskom faces – a constrained power system, with old unreliable and poorly maintained generation fleet as well as the need for new generation capacity.

The risk of load shedding will remain until substantial new power capacity is invested in.

In addition to load shedding, increasing tariffs by Eskom (15%) and municipalities (18%) have further improved the investment case for businesses into renewable energy generation and energy-efficient interventions.

A growing number of business owners are also looking at the option of installing renewable energy technologies to power their daily operations, to hedge against steep increases in electricity costs. We have also seen a growing trend of businesses looking at and investing in battery energy storage systems (BESS) to mitigate some of the effects of load shedding.

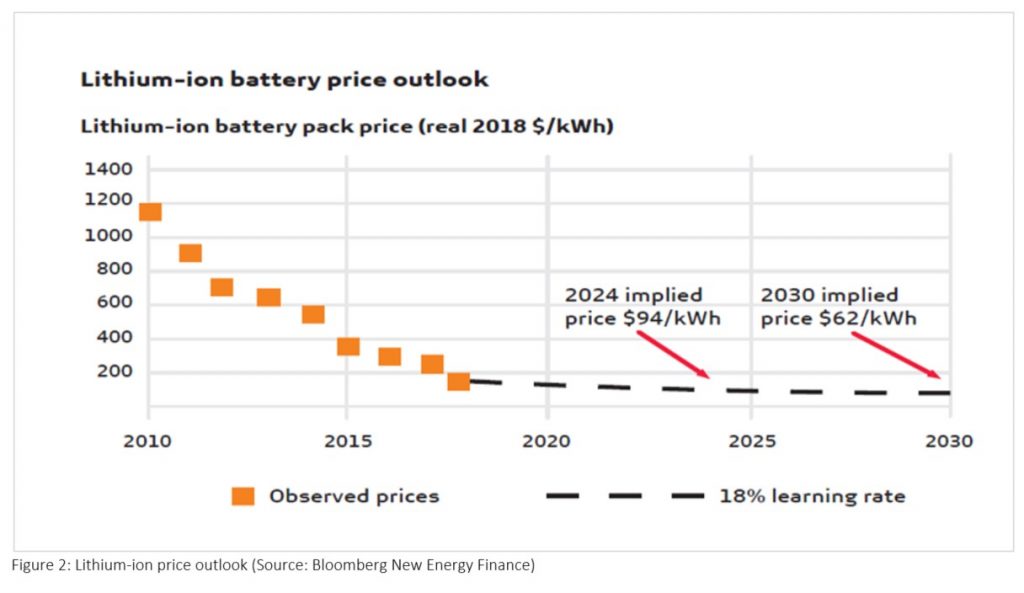

The decline in prices of batteries (in this case lithium-ion) as well as their benefits at times of load shedding have made for a stronger business case.

As a storage system BESS are of interest because of their flexibility of use in many different applications independent of location, in contrast, for example, to pumped hydro storage.

The type of BESS application needs to be aligned with the right BESS technology to maximise value. Different BESS technologies are now available, such as lead-acid, lithium-ion (with many different subtypes), sodium-sulphur and vanadium redox. The BESS technologies have their own key strengths, weaknesses, and performance characteristics.

The characteristics include depth of discharge, power output, weight, energy density, response time, safety, and thermal performance. The technology evaluation is usually done on a case-by-case basis to maximise value from the BESS.

The main uses for BESS are grouped into two categories. Firstly, in stationary applications, such as back-up power and peak demand shaving. Secondly, in mobile applications, such as portable machinery, electric vehicles and cellphones.

Some of the more typical applications of BESS for businesses and farmers are discussed below [increased photovoltaic (PV) self-consumption, peak shaving and arbitrage].

Increased PV self-consumption

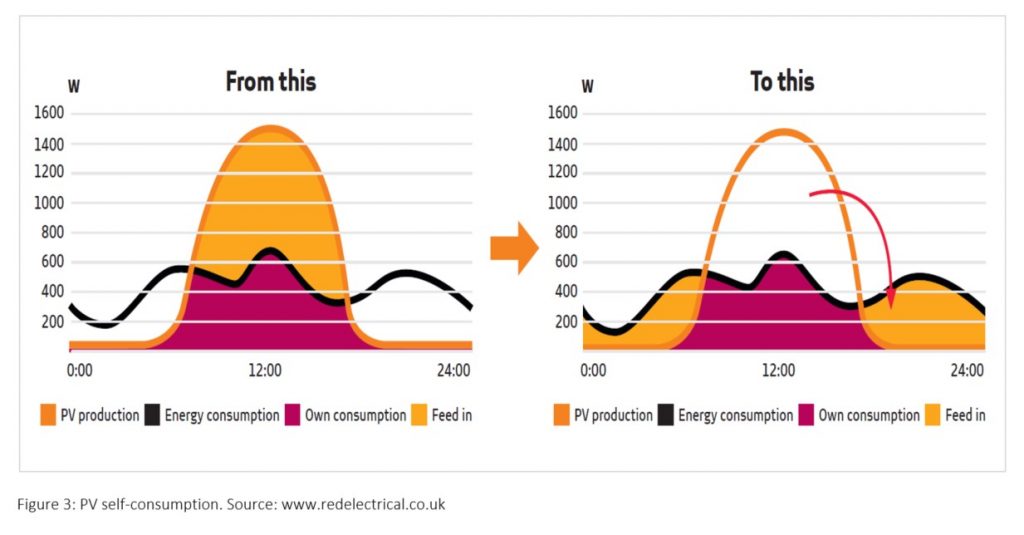

The challenge with renewable energy, including PV panels, is that resource availability (e.g. the sun) does not always coincide with demand.

This is especially problematic for residential or commercial customers, who are often not allowed to supply their excess PV energy back to the utility (generated when there is more solar supply than demand at their premises).

BESSs allow these customers to save this excess PV energy for later use (illustrated in figure 3), increasing these customers’ consumption of their PV energy.

Peak shaving

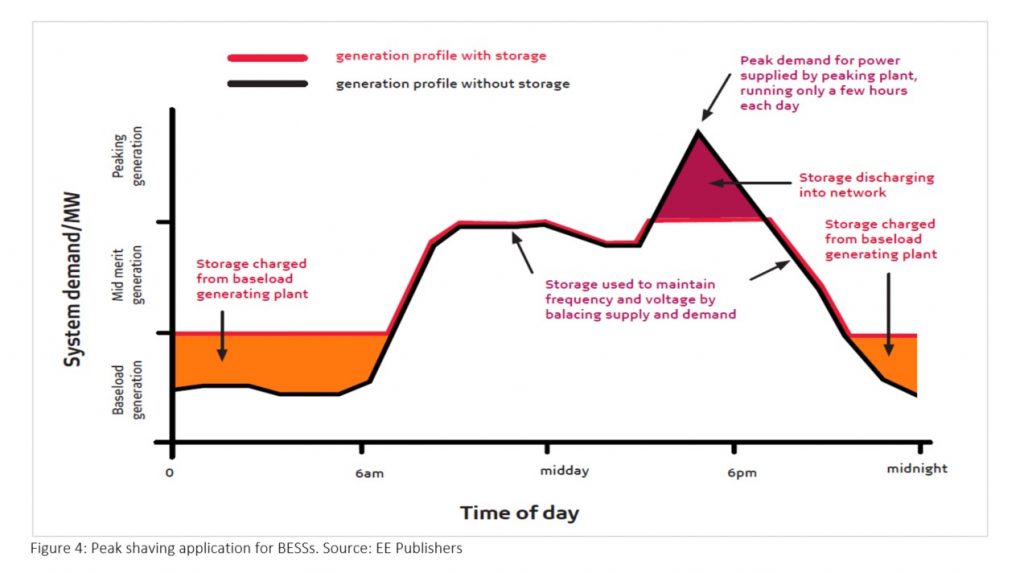

As the demand for energy increases so too does the cost of delivering this energy.

Often the country’s demand is so high, that “peaking generation” units, such as gas turbines, need to be used to meet demand.

Because of the costs of running these “peaking generation” units, electricity tariffs during these “peak” times are higher than during “off-peak” times.

As shown in figure 4, shaving this peak, through businesses and households discharging their energy stored in batteries to supply their peak needs, can be beneficial to both the utility (which saves on expensive fuel) and the end customer (who saves on monthly electricity costs).

Arbitrage

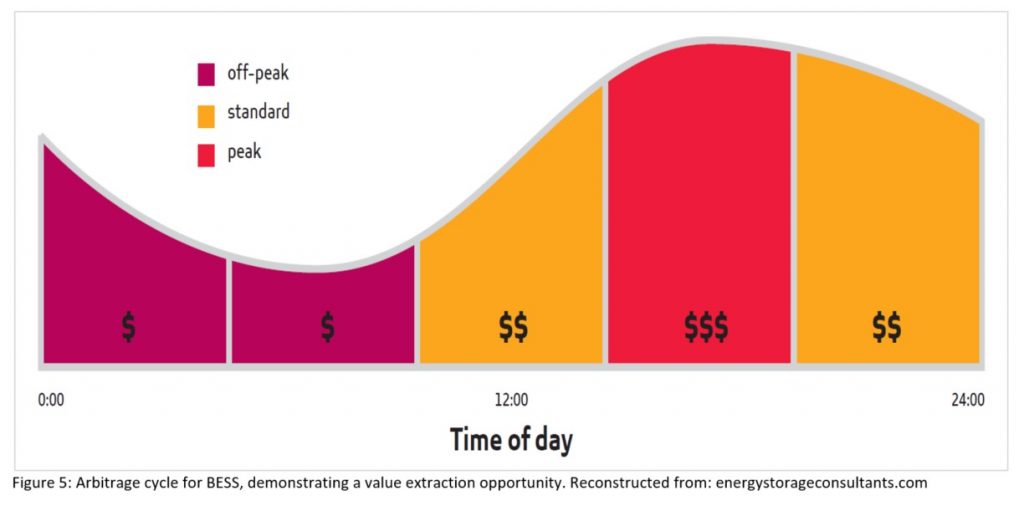

The value of energy, as with any commodity, is inherently linked to demand. The higher the demand, the higher the price of energy.

This pattern can be capitalised by charging a BESS during low-demand periods at a low cost and selling the stored energy at a competitive price during high-demand periods.

This is illustrated in figure 5 – the maroon zone indicates low energy prices and the red zone indicates high energy prices. The difference between the two gives the value that can be obtained.

For your business’ future energy mix, solar PV and BESSs are likely to be the most viable options. Given the declining costs of the technology, increasing energy costs, our abundant sunlight availability and the long lifespan of the technology, the business case is increasingly attractive.

Solar PV is therefore a key enabler, ensuring affordable, reliable and sustainable energy for all.

To find out more on how an agro-processor was able to mitigate the constraints with solar systems and batteries, watch the video by Spif Chickens:

This article is sponsored and supplied by Absa.

Feature image: Supplied by Absa