Zanifu, the Kenyan fintech that enables access to working capital for Micro, Small & Medium Enterprises (MSMEs) by providing short-term stock financing, has secured $1 million (R15 138 300,00) in seed funding.

The startup intends to use the funds to upgrade its platforms and increase the number of MSMEs it empowers by an additional 15 000 FMCG retailers in the next year.

No ad to show here.

Launch Africa Ventures, Sayani Investments, Saviu Ventures as well as numerous angel investors from both Kenya and Nigeria participated in the round which brings the total funding received by the startup so far, to $1.2 million (R18 165 960,00).

The International Finance Corporation (IFC) estimates that 65 million firms, or 40% of formal micro, small and medium enterprises in developing countries, have an unmet financing need of $5.2 trillion every year

“We serve FMCG retailers, especially the ones that are too small to access traditional bank finance for their businesses. The only option these MSMEs have has been digital consumer loans, which are not always suitable for them. We are filling a critical gap in providing stock financing, which enables small businesses to grow their turnovers by more than 40%,” said Zanifu co-founder and chief operating officer, Steve Biko.

“The FMCG segment has the highest working capital needs within MSMEs, and the velocity of the goods they sell allows us to safely underwrite unsecured business credit to them.”

Zanifu was founded by Biko and Sebastian Mithika who launched the financing business in 2018, one year after founding the startup in 2017. To date, the startup has extended 85,000 working capital loans worth over $13 million (R1 967 979 00,00) to 7,000 businesses in Kenya.

Informal businesses are an integral part of Kenya’s economy and contribute 33.8% of the country’s GDP and are responsible for 83.4% of employment outside of small-scale agriculture. Despite this, access to finance remains the main hindrance to growth.

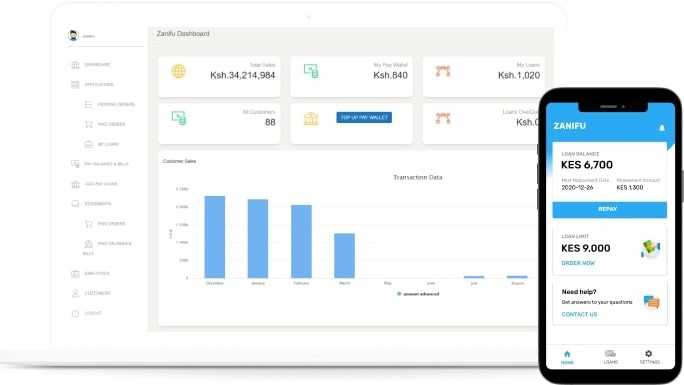

Through Zanifu’s loan app, retailers are able to upload information including historical purchases which the fintech’s algorithm assesses prior to assigning a credit limit. Once the loan is accepted, retailers have up to one month to pay it back with an interest rate of 3.5 to 5%.

According to the World Bank: “Small and Medium Enterprises (SMEs) play a major role in most economies, particularly in developing countries. SMEs account for the majority of businesses worldwide and are important contributors to job creation and global economic development. They represent about 90% of businesses and more than 50% of employment worldwide. Formal SMEs contribute up to 40% of national income (GDP) in emerging economies. These numbers are significantly higher when informal SMEs are included.”

The organisation continues by saying: “However, access to finance is a key constraint to SME growth, it is the second most cited obstacle facing SMEs to grow their businesses in emerging markets and developing countries. SMEs are less likely to be able to obtain bank loans than large firms; instead, they rely on internal funds, or cash from friends and family, to launch and initially run their enterprises.”

Following the successful funding round, Zanifu is now eyeing expansion into Ghana and Uganda which is currently the playing ground for fintech startups Numida and Payhippo who both provide unsecured financing to small businesses.

Read more: Kenyan fintech tech startup secures funding to regionally expand

Featured image: Zanifu