Traditional banking models have been disrupted long before the Covid-19 pandemic fundamentally changed the way we live, work and shop. “We are seeing a rapid rise in digital banking and niche banking, mainly driven by the changing needs of consumers and merchants in the informal economy,” says Zunaid Miya, managing director of Hello Pay.

The pandemic also played an important role in making people more comfortable with digital payment channels and the use of digital products to conduct business in a faster, safer and cheaper way.

No ad to show here.

In South Africa the informal sector is vibrant and a large contributor to the country’s gross domestic product (GDP). Small businesses have blossomed due to rising unemployment, the high costs of living, and persistent structural barriers to economic participation.

Full potential

However, many of these small businesses are not able to achieve their full potential. Several barriers remain, amongst others:

- Internal skills gaps preventing businesses from identifying the digital solutions they need, and adapting business models and processes;

- Financing gaps because small businesses still face difficulties in securing a business loan. Earlier reports by the International Finance Corporation showed that the funding gap for South Africa is estimated at $30 billion.

- Infrastructure gaps as access to high-speed broadband is a prerequisite for the digital transformation of small businesses. Internet penetration rates have been increasing, but the gap between leading countries and businesses; and lagging countries and businesses remains large.

Migrant entrepreneurs and niche banking

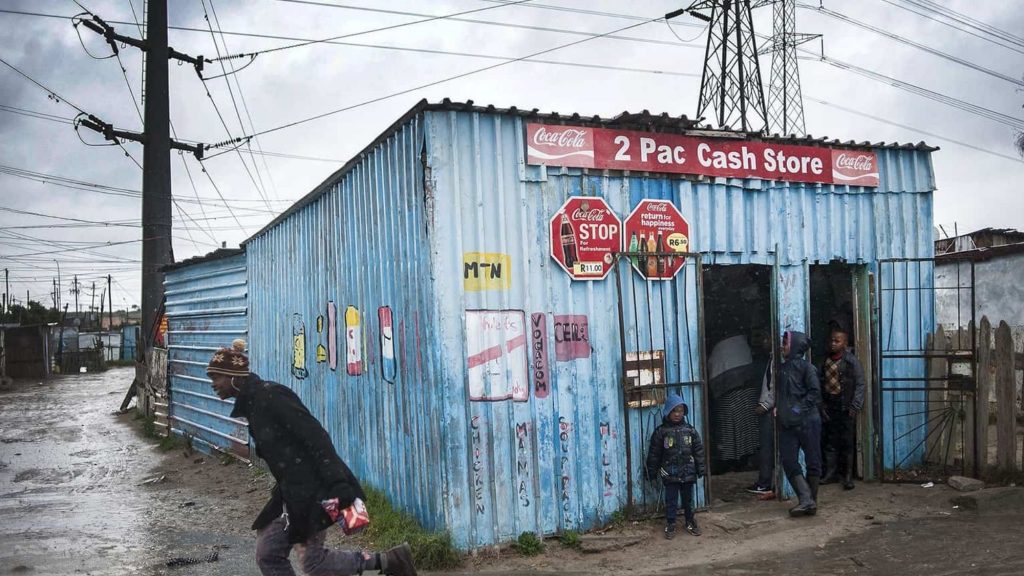

South Africa has seen a growth in migrant entrepreneurs opening shops or taking over the ownership of informal businesses in townships across the country.

Close to three million migrants reside in South Africa, many of whom struggle to access financial services in order to start small businesses like spaza shops, salons and kiosks or to expand their existing businesses.

“Real access to financial services remains low in the foreign national community as well as in local informal and micro enterprises,” says Miya.

Major compliance restrictions in the traditional financial services offering mean many migrants or low-income earners find it difficult to open bank accounts and get access to financing. They may have a bank account, but cost factors prohibit access to other services. An overwhelming number of clients also hold dormant accounts.

“Hello Pay is one of the few companies preparing the migrant market to embrace digital financial processes. We are assisting migrant businesses such as spaza shops, tuck shop and small businesses to move from cash to card payments.”

Our payment devices, allow users to process payments on their mobile phones, get an auto cash-up daily and activate and control multiple devices with one account. It allows them to accept card payments and sell airtime and electricity. By being a Hello Pay customer, merchants also have access to business loans, business cover and armed response through the Hello Pay Business Solution.

Misconceptions

There is a common misconception that card machines are expensive and difficult to operate and maintain. However, township merchants and their customers should realise and understand the risks and costs associated with cash.

Miya also refers to the misconception that spaza shops, hawkers, pavement sellers, street vendors and various other micro-enterprises won’t qualify for a bank account. “We wanted to even the playing field by offering small merchants and migrants the same opportunities as everyone else. The solution not only offers them a way to go cashless but also to protect and grow their business.”

Miya says their digital solutions are “affordable and convenient” offering small business owners the opportunity to expand their businesses, or to gain a competitive advantage. “We offer solutions that resolve business owners’ most pressing pain points,” says Miya. He adds that digital alternatives to cash can offer more bespoke offerings to merchants, enabling them to gain greater traction in the market.

The world continues to evolve towards a cashless and even cardless financial environment. It is becoming more viable, mainly because of financial offerings by companies like Hello Pay. Niche banking focuses on personalisation and offers unique tools because of a better understanding of the needs of underserved markets.

ALSO READ: Pezesha closes $11m funding round to scale fintech