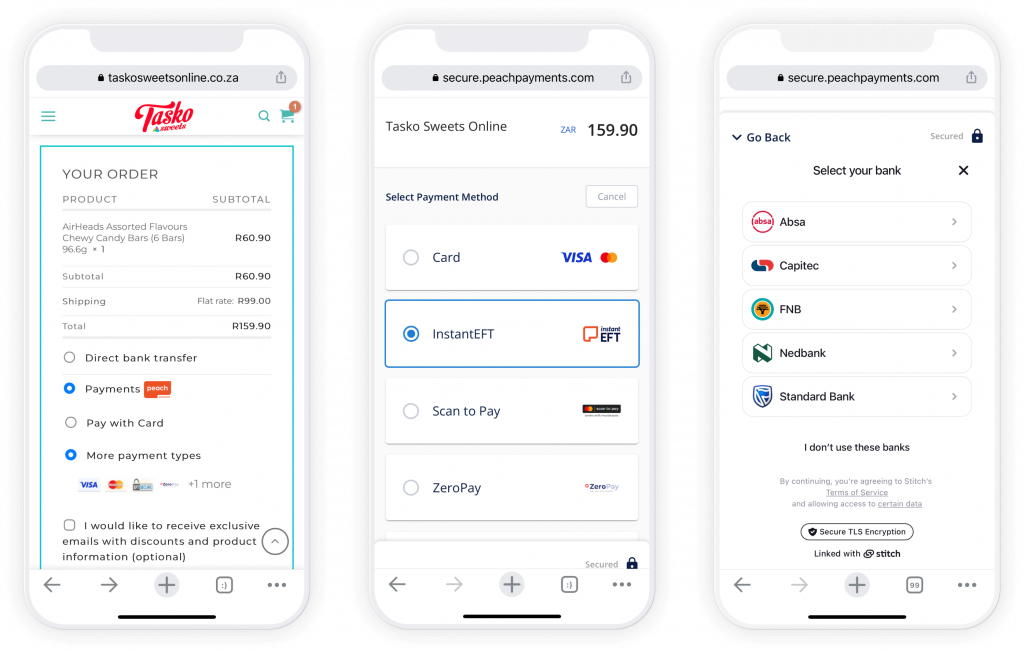

South Africa-based digital payments gateway Peach Payments and API fintech Stitch have partnered to enable online merchants across the country to accept secure, low-cost instant EFT payments.

The payment method is available to all Peach Payments merchants, on any integration platform, as “Instant EFT by Peach Payments” and is enabled by e-mailing the company via its support team.

No ad to show here.

In a media release, the company says customers in South Africa are demanding faster, more convenient and more secure ways to pay as digital transactions and interest in e-commerce continues to grow – rising 66% last year, and expected to reach R225 billion in value by 2025.

As a result, more merchants are coming online, relying on payment gateways like Peach Payments to enable their customers to transact digitally. For merchants that want to offer a variety of payment methods and access a wider market, Instant EFT by Peach Payments offers:

- the second most popular online payment method in South Africa

- superior transaction success rates

- a seamless payments experience, reducing cart abandonment

- higher security measures to reduce fraud

- a cost-effective payment method – making it more affordable than card payments

- additional reach to also serve those without card

- the ability to pay in one click across any Peach Payments merchant for returning users

“In South Africa, Statista found that debit cards make up 33% of all online transactions and credit cards a further 17% — meaning that 50% of online shoppers need other payment methods to complete their purchases.

“We have found that offering a wide variety of different payment methods makes a real difference to businesses’ bottom line. Instant EFT by Peach Payments gives shoppers an additional way to pay, meaning that even if their card doesn’t work, the transaction can still be completed,” says Rahul Jain, CEO of Peach Payments.

Junaid Dadan, Stitch CPO, adds: “Our goal is to make it as easy, secure and cost-effective as possible for customers to pay online – which ultimately means more growth for online merchants who are massive drivers of South Africa’s economy. We’re thrilled to partner with a leading player in payments like Peach Payments to help more merchants get paid easier and receive their funds faster with our Instant EFT solution.”

For over ten years, Peach Payments has made online commerce and digital payments accessible to small and large merchants across the African continent. It works with businesses in Kenya, Mauritius and South Africa, providing a toolkit that enables them to accept, manage and make payments via mobile and the web.

Stitch launched in February 2021 and is live with its payments and financial data API in South Africa and Nigeria. The firm recently raised $21 million in Series A funding, and in April announced the launch of LinkPay, the first payments solution in Africa that tokenises user financial accounts to enable one-click, verified payments and seamless payouts for returning customers.

Stitch launched in February 2021 and has offices in Cape Town and Johannesburg, South Africa, and Lagos, Nigeria, with staff across the globe.

ALSO READ: MaxAB raises $40m to fuel growth, regional expansion