South African consumers want to make purchases at the click, tap or swipe of a card, as fast and as conveniently as possible. The retail industry is booming now more than ever before, and according to CEIC Data, South African Retail Sales have grown 8.8 % year on year in 2022.

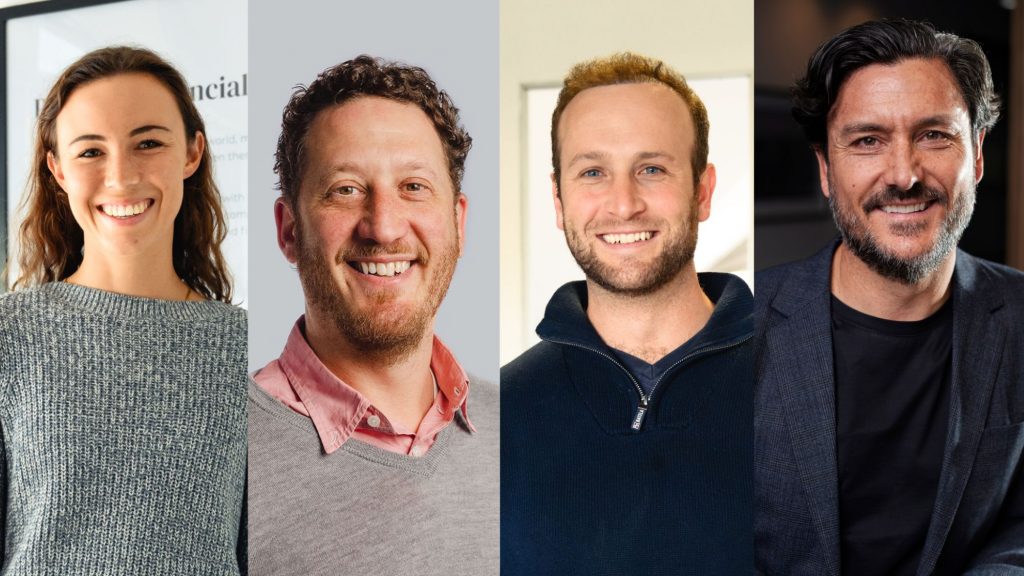

“South African retailers are needing to adapt to the needs of a fast-paced, tech-savvy and empowered consumer,” adds Lara Du Plessis, head of partnerships at FundingHub. This behavioural shift has meant that SMEs need to up their game before the busier periods to continually meet the needs of their target audience.

No ad to show here.

Let’s take a look at a few tactics SMEs can follow to get a step ahead.

Online & in-store innovation

Black Friday, CyberMonday and the festive season period should be permanent fixtures in your marketing calendar. “

“Your online presence and physical store experience need to be sleek, attractive and as easy as possible for consumers to purchase products,” believes Ashleigh Butterworth, content marketing specialist at Finch Technologies.

In addition to making sure your website and social media channels are updated regularly, you’ll need to make sure you are thinking out of the box. Collecting email addresses before the busier periods is a smart move, where you’ll be able to entice consumers with exclusive access to sales and new product launches.

If you’ve launched a new product, encourage your customers to post photos of them using the product, with the incentive of a discount or prize.

For SMEs and larger physical retail stores, in-store innovations will keep their customers coming back for more. Experiential marketing tactics like free samples, in-store classes & workshops, virtual reality try-ons or festive gift wrapping – if executed well create an A-class brand experience.

According to Forbes, 73% of consumers are willing to spend more if they love the brand experience.

Prepare for load shedding

With no plans of slowing down, load shedding has become the norm (once again) in South Africa. According to economist Hugo Pienaar, the cost to the economy of an hour of stage 6 load shedding during business hours is about R500 million.

While Eskom scrambles to fix this shortfall, it’s vital for SME retailers to take action and come up with a game plan themselves. For retailers, alternative power solutions should be top of your list before the festive season. If budget and time allow, look at installing an inverter or generator, this will be a great long-term solution for your physical store or offices.

A basic UPS system, is a great cost-effective short-term solution to get you through the busy season. Laptops, Wi-Fi and payment systems all need to stay powered up, so ensure your UPS can at least run the essentials.

Integrate payment technologies

Paul Kent, group chief executive of adumo says, “Busier periods mean an increase in customer footfall, causing queues and possibly abandoned carts, as frustrated customers leave the stores. Embedded payments reduce queues with one seamless payment transaction, by integrating card payments into the Point-of-Sale software.

“Benefits include faster transactions as well as a reduction in manual errors and the administrative burden of reconciling and having to manage multiple providers.”

As a business owner, you want to make sure you are catering for varying customer payment preferences, especially during busier periods. Retailers that provide customers with more control over how they shop and pay for items are more likely to reduce the volume of abandoned payments.

Mr Price aims to service their clients’ needs where and when they need it most, in-store customers are able to pay with a card at Mr Price’s mobile POS systems without having to go to a till. For the retail group, this means shorter queues and faster checkouts – leading to more sales.

“Making sure that you can accept payments from customers via whatever method they prefer is critical,” says Peach Payments head of SME growth and marketing Joshua Shimkin.

“Many South Africans don’t have credit cards, so ensure you offer alternatives like Instant EFT, QR codes and other easy, convenient ways to pay. Businesses should consider Buy Now, Pay Later methods which offer shoppers flexibility when paying for larger purchases. For consumers who do prefer credit cards, ensure you have advanced, one-click checkout so people do not need to enter credit details multiple times.”

Get the business funding you need

Whether you are running low on inventory, or you are looking to hire seasonal staff for your retail store. Either way, business funding might be the ideal solution to get you through the festive season and ensure you turn a profit. SME retail funding remains elusive, according to the World Bank, sub-Saharan Africa faces a huge finance gap of US$330 billion.

“Part of the issue is a lack of financial inclusion and education, SME retailers aren’t aware of the funding they are able to qualify for,” says Christopher Ball, managing director of FundingHub.

A Merchant Cash Advance is the ideal funding type for retailers who don’t necessarily have collateral to put up but can use their monthly transactions to secure funding. For a lender, the value lies in the income-generating transaction, whether that be collected via a POS or EFT.

A merchant is essentially buying early access to their expected turnover so that they can use the finance they need. If you are unsure about the type of funding you can qualify for, marketplace platforms like FundingHub compare business finance offers from multiple lenders.