South Africa’s fastest growing digital bank, TymeBank, which is set to reach the six-million customer mark this month, announced that its acquisition of Retail Capital is now complete after it was granted all the necessary regulatory approvals.

The bank has fully acquired Retail Capital, an award-winning fintech company that provides funding to small and medium-sized businesses, in a deal worth R1.5 billion. Work is now underway to integrate the organisations.

No ad to show here.

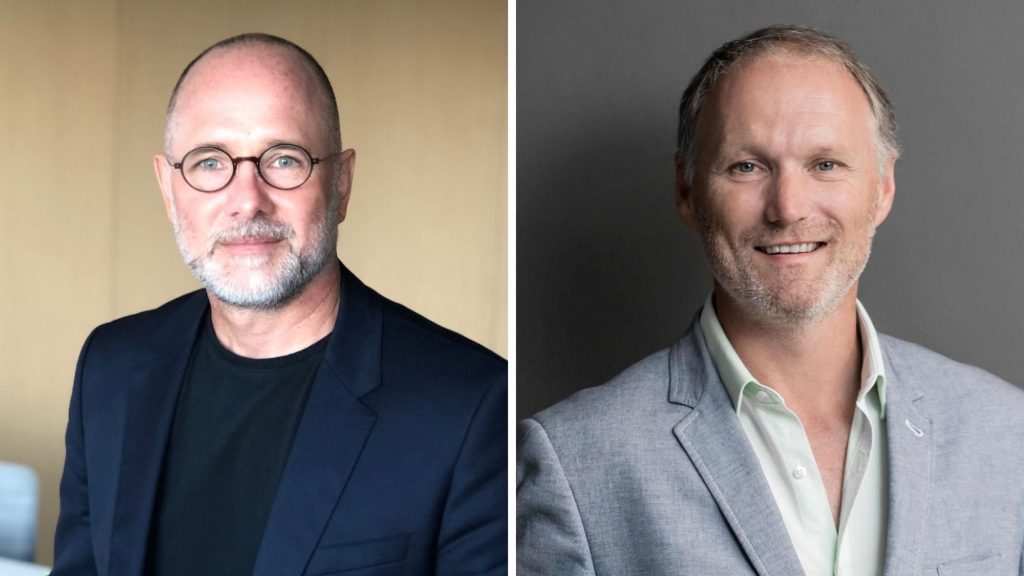

In terms of the acquisition, Retail Capital will become a division of TymeBank before the end of December 2022. Retail Capital chief executive Karl Westvig will join Tyme Group’s executive committee and will be responsible for TymeBank’s business banking and lending offerings.

Commenting on the transaction approval, TymeBank chief executive Coen Jonker said: “This is our first acquisition and the beginning of a new era for TymeBank as we branch out into working capital funding for small businesses. We are excited to welcome Karl and the Retail Capital team into the TymeBank family.

“TymeBank Business Banking is strengthened by a quality acquisition and a high calibre team and we look forward to making business banking and access to capital more affordable for South Africa’s small business owners and entrepreneurs.”

There are no immediate plans to rebrand Retail Capital, which will continue to operate as usual, confirmed Jonker. “We want to maintain commercial momentum so we will focus on making the integration as seamless as possible, while meeting all the regulatory and reporting requirements of a single business.”

Westvig will head up TymeBank’s Business Banking division, which already has over 120 000

customers with a transactional business account that can be opened in under five minutes. TymeBank business customers benefit from zero monthly bank fees, free debit card and online purchase transactions, as well as free bulk payments, among other benefits. Business customers also have access to TymePOS, a mobile point-of-sale app that turns an NFC-enabled cell phone into a tap-and-go payment device.

Retail Capital lowers the barriers to accessing working capital for SMEs through an easy, three-step online application process. In the last 10 years Retail Capital has already provided more than 50 000 business owners in South Africa with over R7 billion in working capital, making it the largest SME funder of its kind in the sector.

“There is an incredible synergy between Retail Capital and TymeBank, starting with the ethos

to provide affordable banking to consumers and businesses. The cultural fit is seamless and the power of Tyme’s technology, distribution and deposits and Retail Capital’s funding capabilities makes this a very natural partnership.

“Small businesses in particular require support to grow and employ more people, leading to a more prosperous future for us all,” said Retail Capital chief executive Karl Westvig.

Since its inception in 2011, Retail Capital has developed a robust risk decisioning process for small business funding products, launched a successful set of fintech partnerships, and developed the underlying technology for embedded funding solutions.

The company has also built an experienced executive and operational team, and are currently profitable and capital generative. Over the past decade, it has funded more than 50 000 business owners with over R7 billion to date.

ALSO READ: Seedstars launches programme for women-led startups