Four young scientists, accompanied by Eskom Expo’s Business Manager, Mmamoloko Rancia Riba, won their place to represent the country at the Indonesia competition, renowned…

Embedded finance: Fintech innovation to reach turning point

The “grandfather of South African fintech”, Christo Davel, believes that 2023 is a key year for fintech innovation in the country as businesses and brands scramble to launch financial offerings and embedded finance to the same customers.

Those who are not embracing e-commerce and s-commerce, mobile payments, cashless financial services offerings, real-time payments or embedded services such as buy-now-pay-later (BNPL), electronic wallets and embedded insurance will drop out of the race, according to Davel, chief commercial officer of Direct Transact.

He believes South Africa is reaching a fintech turning point this year, and large successful retailers and brands that are not innovating will be in trouble. A number of global forces are conspiring to bring the retail fintech innovation game to a head in 2023.

Factors such as rapid post-Covid digitisation, an exponential data and artificial intelligence (AI) boom, the rise in inflationary consumer pressures, logistical challenges for importers and exporters, fuel price increases, and hyper-connected ecosystems in response to “permacrisis,” are putting unprecedented pressure on retailers and brands to use fintech innovation to meet the changing needs and frustrations of their customers.

Embedded finance is at the centre of this shift, according to Davel.

“Embedded finance is when financial services are embedded in an existing customer engagement with a trusted brand, with zero friction or additional effort. If it’s done well, it’s invisible and simply part of an existing brand experience.

“The clever use of AI and data can allow brands to offer smarter, more relevant benefits to their end-users. The opportunities for data-driven personalization of transactions that are embedded in everyday experiences are infinite.”

A recent global analysis by Accenture forecasts that embedded banking for the small and medium-sized business sector will boom this year and could capture up to 26% ($32 billion) of the global SME banking revenue by 2025, while at the same time other digital platforms that offer embedded finance could expand by $92 billion.

Deloitte’s 2023 Banking and Capital Markets Forecast also predicts that embedded finance revenues will explode between now and 2025 to reach a total estimated value of $230 billion.

Davel believes successful embedded finance starts on the customer need side. Those players who are uncovering and improving the real customer friction points in a smooth yet compliant way will win.

“Ben Robinson of Aperture says it well when he says that it’s all about financial services being embedded into a channel that a customer already uses, in the existing user journey. The context is understood and, by extension, the need is understood.”

Davel says many brands are now exploring new ways to build financial services into their customer interfaces but are finding it hard to get that innovation right all by themselves.

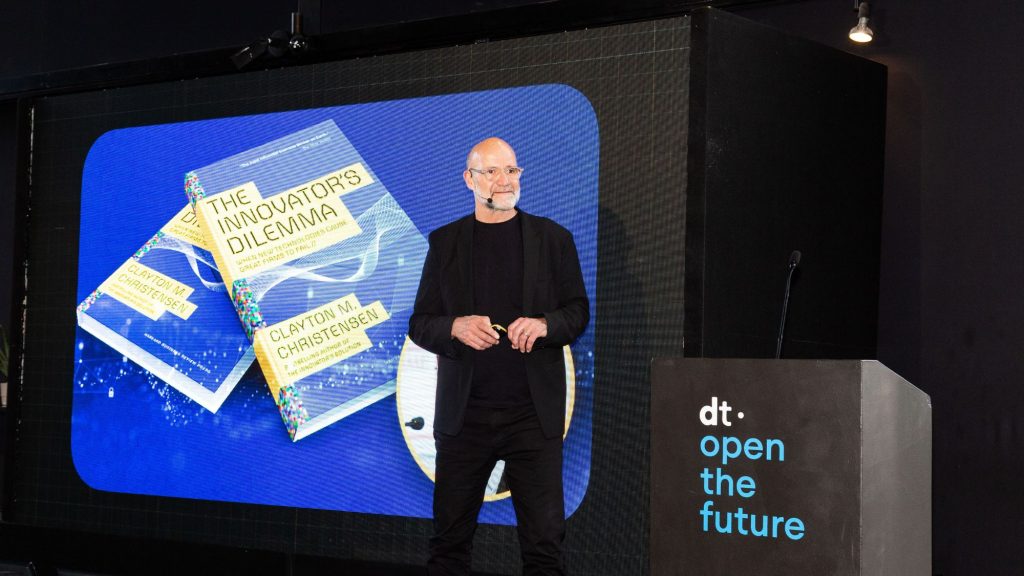

“The fact is that it is hard for big companies to innovate, especially when there is so much risk and pressure in the market. The problem is well-described by author Clayton Christensen in his iconic book The Innovator’s Dilemma. But this can no longer hold our retailers and brands back.

“In 2023, if they have not done so already, they will have to find partners in the local fintech ecosystem who can help them embrace a more open, collaborative future. Retailers, for instance, can work with an agile bank and outsourced banking-as-a-service partners to build new products and services that will achieve more customer satisfaction and stickiness.”

The key to innovation is openness, says Davel.

“Openness can only work if you bring together innovation, opportunity, and collaboration. In South Africa, retailers like Shoprite are partnering with banks and a host of fintech players including Direct Transact, to roll out financial services solutions their customers want. Pick n Pay recently announced that it is accepting Bitcoin. MTN and Vodacom are both exploring fintech innovations.”

Davel concludes that it is an exciting time for local fintech innovation. “Those who will benefit are the consumers, both on the high-income end, wanting superior mobile payment convenience, and in terms of financial inclusion and remittance and credit convenience for the unbanked. The companies that don’t innovate and evolve this year will lose those customers.”