TCL Electronics has officially launched its 2025 range of Mini LED TVs in South Africa, introducing cutting-edge display technology, massive screen sizes, and cinematic…

Workpay secures $2.6m in pre-Series A funding round

Workpay, a Kenyan HR payroll start-up co-founded by chief executive Paul Kimani and COO Jackson Kungu, has secured Ksh 342 million (about $2.6 million) funding in a pre-Series A round.

The funding round saw the participation of Launch Africa Ventures, Saviu Ventures, Acadian Ventures, PROPARCO, Fondation Botnar, Kara Ventures, and Axian Group Norrsken. The company provides employers with a platform to process employee salaries, benefits, file taxes, and keep track of their attendance and leave days.

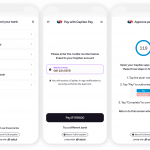

Workpay, which was launched in 2019, also enables employees to have their own app where they receive and view their pay slips, make expense requests, and apply for leave days.

Kimani confirmed the news in a LinkedIn post and revealed that the company plans to expand its services across other African markets. Workpay is backed by Y Combinator and was part of the American tech start-up accelerator’s 2020 class, where it raised Ksh.266 million ($2.1 million) seed funding.

Start-up accelerators, also known as seed accelerators, are fixed-term, cohort-based mentorship programs that provide guidance, support, and limited funding in exchange for equity. Typically, these programs end in a public pitch event or demo day.

Workpay was also selected for Google’s Black Founders Fund for Africa in 2021, further cementing its position as a fast-growing start-up. According to Kimani, the company has been doubling its revenue every year since 2021 and has nearly 700 customers as of writing. The company handles around $200 million in total payroll value for its customers annually.

Workpay’s upcoming products are set to offer greater flexibility to employees, providing easier access to their salaries. The company also plans to introduce linkages to investment accounts, medical and asset insurance, and earned-wage access for employees attending to emergencies or bills, according to American tech outlet TechCrunch. Workpay already has offices in Nigeria and is keen on expanding its footprint across other African markets.

The company’s success can be attributed to its ability to simplify HR and payroll management for businesses, enabling them to focus on other areas of their operations. Workpay’s solutions are particularly useful for small and medium-sized enterprises (SMEs) that lack the resources to maintain an in-house HR and payroll department. The company’s emphasis on employee self-service also streamlines HR operations and improves the employee experience.

Workpay’s latest funding round is a testament to the company’s growth and its potential to transform HR and payroll management in Africa. With its innovative solutions and expanding presence, Workpay is well-positioned to capitalise on the growing demand for HR and payroll management services in Africa, particularly among SMEs.

READ NEXT: Blockchain Africa: Empower Africa for global competition