In a breakthrough move that marks the continued rise of South African tech on the global stage, homegrown fintech leader ClickSendNow announced a strategic partnership with ThetaRay, the frontrunner in AI-powered transaction monitoring technology.

In a push towards seamless scalability and stringent security, ClickSendNow plans to integrate ThetaRay’s innovative SONAR platform to bolster its automated transaction monitoring and sanction screening operations.

No ad to show here.

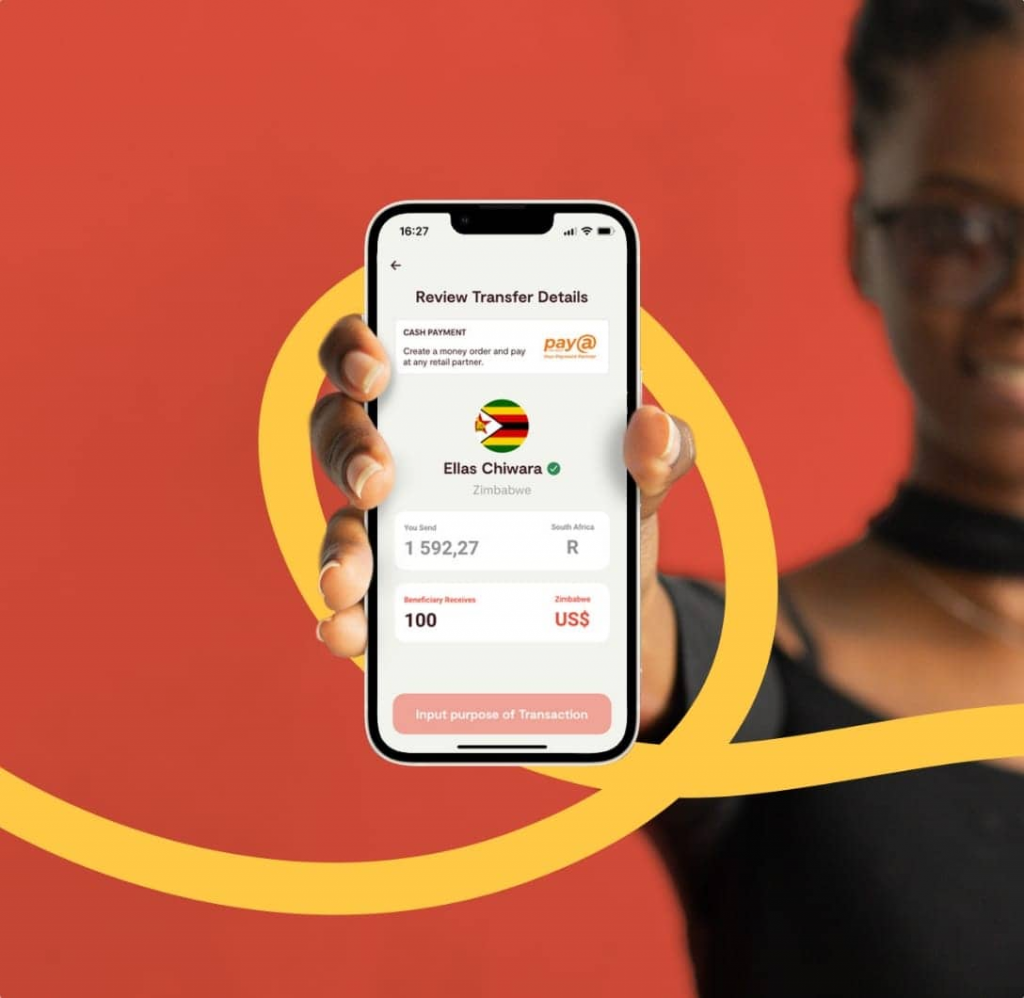

Established in the vibrant tech hub of South Africa, ClickSendNow has made its mark by offering streamlined remittance payments to over 30 countries in Africa.

With the integration of ThetaRay’s trailblazing anti-money laundering system SONAR, ClickSendNow is poised to tackle the often-elusive threat of financial fraud and money laundering, allowing the South African tech firm to maintain its rapid growth trajectory while ensuring the utmost security.

“Our mission to redefine remittance payments across Africa hinges on the leverage of advanced AI for our AML processes,” said Tyler Slement, chief executive of Clicksendnow.

“ThetaRay’s unique technology for analysing transaction database norms and patterns sets a new benchmark in the industry, and we’re thrilled to harness their system to continue our rapid, secure expansion.”

ThetaRay’s pioneering full-stack detection platform uniquely combines rules-based, AI/ML risk-based, and network visualisation techniques. Known for its proficiency in reducing false positive alerts by up to 90% and slashing analyst time in half, it provides unrivalled insights into financial networks, while detecting all unknown cases with remarkable speed and transparency.

ThetaRay’s CEO, Peter Reynolds, expressed excitement about partnering with a rising star in the African tech scene. “In the global race to achieve a 3% target on remittance payments, it’s crucial to foster an efficient and secure financial network.

“We’re honoured that Clicksendnow, a shining beacon of African fintech innovation, has chosen ThetaRay’s AI-powered system to continue delivering an unmatched customer experience while upholding the highest standards of AML compliance.”

READ NEXT: SA tackles unprecedented unemployment with learnerships