LG’s 100-Inch QNED evo AI TV Redefines Big-Screen Viewing in South Africa In a bold leap forward for home entertainment, LG Electronics South Africa…

Section 12J funds that invest in property are a tax dodge says Vinny Lingham

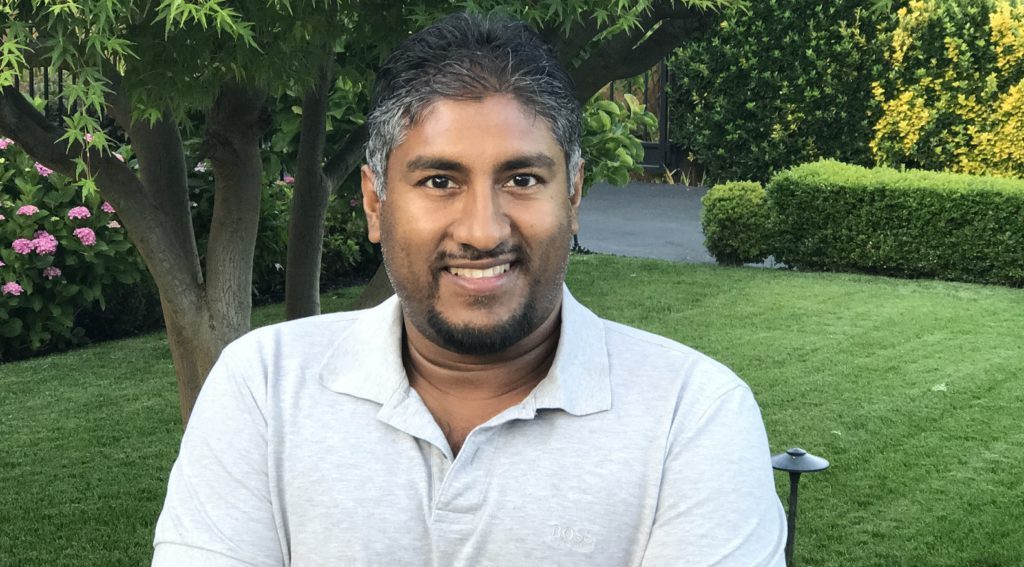

Silicon Valley based SA entrepreneur Vinny Lingham says too many funds approved under South Africa’s Section 12J venture capital (VC) tax incentive are using “financial re-engineering” such as investing in property, to allow the rich to “dodge” paying tax.

The incentive, which came into effect in 2009, entitles investors that invest in accredited VC companies that then invest in small businesses, to make a tax deduction of 100% in the year that the investment was made. To date the SA Revenue Service (Sars) has approved over 120 such funds.

Lingham, who it was revealed earlier this month is involved in a R500-million Section 12J fund that plans to invest in tech startups and social impact firms in South Africa (see this story), believes the incentive would be best deployed by funds that help firms to rather cover risky research and development (R&D) costs.

In a Google Hangouts call yesterday with Ventureburn, Lingham slammed the proliferation of Section 12J funds approved by Sars that focus on the property sector.

“That’s basically tax dodging to be honest, because venture capital only works if you have like multiples of 50, 100 times your money in return, that’s how venture capital works.

“It doesn’t work when you are like trying to dodge taxes and gear up your investments and are using tax money to get better gearing. That’s what’s happening on the Section 12J funds today.

“They’re using tax money to get better gearing on their investments. That’s not venture capital in the true sense,” he said.

Investments by Section 12J funds in property is basically tax dodging, says Silicon Valley based SA entrepreneur Vinny Lingham

His angel investment company Newton Partners is currently partnering with investment house Lion Pride in Lion Pride Agility VCC Fund, a Section 12J fund which aims to invest in tech startups and social impact businesses.

While he believes South Africa has “huge potential for investment”, he said the country lacks sufficient entrepreneurs that are also investors — who are arguably better able to invest in entrepreneurial ventures, having taken part in such ventures themselves.

“The biggest issue is that a lot of the investors are money managers and not entrepreneurs and I think this fund (his Lion Pride Agility VCC Fund) is different — you have a combination of people who know how to manage money and who know how to build companies and that’s a really solid combination,” he said.

‘No Silicon Valley-style investing’

What he called “Silicon Valley style investing” is something that South Africa has not seen to date.

“We’re still pretty bleak about venture capital in South Africa – not venture capital in particular, but just the way that entrepreneurs have been treated by the VCs in South Africa today.

“It’s been pretty dismal and as a result the businesses and the outcomes have not been great,” he said.

Lingham’s fund is the second fund that has been launched in recent months that will focus on investing in tech startups. Last week Durban based venture capital (VC) company Kingson Capital announced the launch of a R400-million VC fund aimed at investing in 30 to 50 tech startups and black-owned small businesses (see here).

Lingham is never scared to give his opinion — but the question now is – can his fund make a difference? We may be about to find out.

Read more: New Vinny Lingham linked R500m VC fund currently mulling 15 investments [Updated]

Read more: SA VC Kingson Capital launches R400m fund to target tech startups, black SMEs [Updated]

Read more: Section 12J industry body established to ensure industry sustainability

Read more: What investors should look for in a Section 12J VC company [Opinion]

Read more: State must close door on those that misuse VC tax incentive [Opinion]

Read more: Savca raises concern over governance issues in Section 12J VC tax incentive

Read more: Venture capitalists welcome Section 12J proposals but call for more changes

Read more: Investors clamouring for 12J VC incentive following tax hike – fund managers

Read more: Can 12J VC tax incentive create the jobs South Africa badly needs?

Read more: Foreign investment injection could propel South Africa’s VC ecosystem, 12J funds

*Correction (15 February 2019): In the initial version of this article we mistakenly stated that SA’s venture capital (VC) tax incentive allows investors that invest in accredited VC companies that then invest in small businesses, to make a tax deduction of 125% in the year that the investment was made. It is in fact 100%. We regret the error.

Featured image: Silicon Valley based SA entrepreneur and Civic founder Vinny Lingham (Supplied)